So, you’re looking for a retail space to lease? How exciting! Independent businesses are moving in to fill the vacant spaces left by big brands after the pandemic. Naturally, we love to see it.

But if we’ve learnt anything from writing about finding a retail space, and speaking to other independent businesses who’ve been through the process, it’s that finding the right space with the right terms isn’t always an easy journey. And there’s a lot of jargon to unpick along the way.

Stick with us as we unpack exactly what you should be looking for in your retail space. And a quick disclaimer — we’ve put many hours into making the information in this post as accurate as possible, but we’re not lawyers! You should always get a trained legal professional to look over a commercial contract before you sign up. Now, let’s get to it!

Finding & leasing a retail space:

- Where should you look for a retail space?

- Understanding a commercial listing: 12 terms to know

- Other costs and need-to-knows

- Finding the right area

- Considering the pop-up optio

Where should you look for a retail space?

While you can use a commercial property agent to speed up your search for a commercial space, you definitely don’t need to. Zoopla, Rightmove and LoopNet all have commercial space listings.

Understanding a commercial listing: 12 terms to know

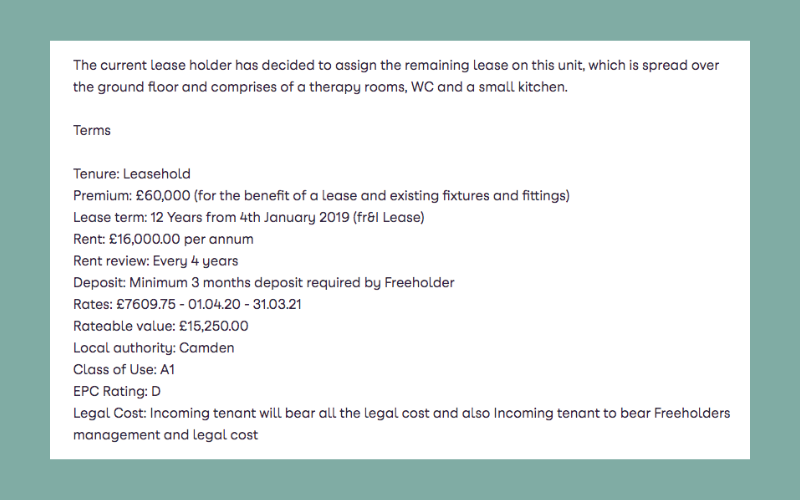

Finding a retail space listing is one thing. Understanding it? That’s a whole other matter. Here’s an extract from a real life commercial property listing on Zoopla, followed by a breakdown of exactly what each of these terms means:

1. Tenure

Tenure refers to the conditions under which you’ll be taking on a building.

‘Leasehold’ means you’re just paying a fixed amount to use the property for a set period of time (renting). The alternative — ‘freehold’ — means you’re buying the property.

2. Lease term

The lease term is how long you’re agreeing to rent the retail space for. UK real estate chain Savills placed the average commercial lease term at 5.5 years back in 2020, but also noted that more landlords were open to shorter leases due to the pandemic.

This fed into our co-founder Fahad Khan’s number one piece of advice when it comes to searching for the perfect space:

"Try to get your lease on a short-term basis before committing longer than 3 months. Relevant traffic for shopping is very different to footfall in general, so don’t jump into a lease just because the high street looks busy." — Fahad Khan, co-founder of CREOATE

With vacancy rates still pretty high following the pandemic, you’re in a strong position as a potential tenant. If you don’t ask, you don’t get!

3. Rent

The amount you need to pay to your landlord every month, quarter or year. Here the figure is given as per year, but is more likely to be payable per month.

4. Rent review

If a rent review is set into your contract (as it would be for this property), the landlord can raise your rent after the stated period of time (in this case, every four years).

Rest assured though, this increase can’t be random — instead, it’s calculated by one of the following two methods (and the method will be stated within the contract).

- RPI rent review: RPI stands for Retail Price Index. If you have an RPI review, your rent will rise in line with general inflation. So if prices have gone up by 2% overall, your rent will be raised by 2%.

- Open market rent review: An open market review reevaluates how much the property could be leased for at the time of review. It’s tied to the state of the property market, and your local area. That said, most open market rent reviews are written to be ‘upward-only’, meaning rent can’t actually decrease.

Both options have their pros and cons, but if you’re moving into an area you’d class as ‘up-and-coming’, an RPI rent review is likely to be a safer option.

💡 Good to know: ‘Caps’ and ‘collars’ can be written into your contract to put a limit on how much your rent can increase. Make use of these if you can!

5. Deposit

Commercial landlords typically ask for a deposit of between three and six months’ rent. In this case, it’s three months.

A deposit is an amount of money which is required upfront when you sign for a lease. Your landlord will use this money if you’re unable to pay your rent during your tenancy. Unlike deposits for residential properties (i.e. when you rent somewhere to live), commercial deposits aren’t typically held to cover damages, but it’s worth clarifying this when a contract is drawn up.

6. Premium

This is a one-off, upfront payment to be made to the current leaseholder, who is looking to ‘assign’ (hand over) the remainder of their lease to a new business. It’s the cost of ‘buying’ the lease.

The word ‘premium’ would also be used to describe a one-off, upfront payment to the freeholder (a.k.a landlord) when a completely new lease is being granted. In this case, you may be able to deduct some of this from the future earnings of your store.

💡 Good to know: ‘Reverse Premiums’ exist! In cases where a commercial property is in a particularly bad condition, or proving difficult to shift, the landlord might actually pay you a premium to take on the lease.

7. Rates

Every business with a physical premises has to pay business rates (a tax), which is specific to each premises. Business rates are calculated by multiplying the rateable value (see below) by a multiplier set by the government.

For the year 2024-2025, the standard multiplier is 54.6p, and the small business multiplier is 49.9p. Apply the small business multiplier if the rateable value of the property is under £51,000.

So in the example above, you’d pay roughly £7,609.75 per year in business rates. If your business's rateable value is under £15,000, you'll also be able to apply for small business rate relief.

8. Rateable value

This is a prediction for how much money these business premises would make in a year if rented on the open market. Rateable values were last set in 2021 by the Valuation Office Agency (VOA).

9. Local authority

Your local authority is responsible for all the public facilities and services within a set area. In this case, the local authority is Camden — a borough within London.

10. Class of use

‘Commercial property’ as a term includes shops, offices, and everything in between. But that doesn’t mean you can use just any commercial property for your business venture.

Each commercial property has a ‘class of use’ assigned to it. In this case, it’s A1, which means the property can be used for: shops, retail warehouses, hairdressers, travel and ticket agencies, post offices, pet shops, sandwich bars, showrooms, domestic hire shops, dry cleaners, funeral directors.

Found your dream property but got the wrong class of use? Don’t worry, all is not lost! Some changes between classes are permitted, but you’ll still need to apply for planning permission from your local authority.

11. EPC rating

An EPC rating is a measure of how energy efficient a property is. Each property is given a rating between A and G, where A is the most efficient.

You can find the energy certificate of any property online. This will give you both the current rating (in this case, D) and a potential rating, which is what the property could achieve with some improvements.

12. Legal cost

You’ll need the help of a solicitor to sign for a commercial property. While it’s hard to put an exact figure on this, it’s wise to budget around £2,000, although it should ideally come out as less. Opt for a legal advisor offering a fixed-price fee arrangement if possible, so there are no hidden surprises. As a tenant, you often need to bear the landlord’s legal fees too, as is the case here. We’ve factored this into the £2,000.

Other costs and need-to-knows

Tenant improvement costs

The landlord may ask that improvements are made to the property, which you need to undertake. While they may give a budget for this, it will often fall short of the full cost of the work. If they’re asking for work that feels substantial, get a contractor to quote for the work upfront so there are no surprises later down the line.

Administrative fees

The landlord may build a monthly ‘admin’ fee into your contract, but this should be negotiable.

Stamp duty

In the same way you pay stamp duty when you buy a house, there’s also stamp duty to be paid when you take on a commercial lease. It’s calculated based on your premium, lease length and monthly rent, and needs to be paid within 14 days of the ‘effective date of the transaction’. Online information and calculators for commercial stamp duty are pretty dicey — we recommend getting your lawyer’s take on this.

Finding the right area

How do you find the right area, and the right property for your business?

If you’re reading this post, chances are you’ve already been dreaming of opening a shop, and have a vision of where it’ll be. But try asking yourself the following questions to really narrow down your options when thinking about a location:

Is this location somewhere you’d happily spend a lot of time?

Opening a retail store is a pretty all-consuming task, particularly for the first couple of years. Until you have the budget to hire a larger team, you can expect to be in the shop pretty much every day. Do you like the area you’re looking at? Is it easy to get to, or are you happy to move nearby?

Will your shop be dependent on random footfall, or repeat customers?

A busy street is ideal for a shop where people ‘pop in’ for things they don’t necessarily need, but it inevitably comes at a premium. If your store is more specialised, or you’re planning to go in heavy on local marketing, could you save a bit of money by setting up somewhere a little quieter?

Lauren, co-founder of mlkwood store, had this advice for businesses who don’t benefit from a lot of passing trade:

"Keep at it. It takes time for people to get to know you. I would say eye-catching marketing is alway helpful, especially social media. Also, get involved with exciting local and out of town events – this is a great way to get yourself out there and chatting to others." — Lauren, mlkwood store. Read the full interview.

How does business feel in your area?

Business-wise, does the area feel ‘up-and-coming’? Hopefully it’s an area you’re quite familiar with, so you can see how businesses have been moving into the area, or leaving it. But a good measure is also to track back commercial rents in the area over the past few years, and see if they’ve increased. The pandemic may have skewed things slightly, but stagnation/decline could be a bad sign.

Is anyone in the nearby area doing what you are?

While retail clustering (see below) can be a legit business tactic, doing it by accident isn’t ideal. Scope out the area very carefully, and try to dig up information on who will be filling any other vacant commercial spaces nearby.

Retail clustering: good or bad idea?

Retail clustering is the practice of setting up shop close to direct competitors. This may sound like an automatically terrible idea (why share your footfall with someone else?), but it’s a decision many businesses actually take for very deliberate reasons. That said, it’s by no means right for everyone. Let’s take a look at a couple of examples:

1. Tom is opening a bookshop. He has his heart set on a commercial property on his local high street, but there’s another bookshop based two doors down. Customers are loyal to the more established bookshop, and go there to buy the latest releases. Tom is forced to work extra hard to make sales by running heavy discounts, which reduce his margins and leave him stretched.

2. Julia is opening a gift/lifestyle shop. She decides to open her shop on a street set back from her main local high street, where several independent gift/lifestyle shops have opened in the last few years, as well as a couple of coffee shops. This area has become a hub for those looking for a last-minute gift, or having a lazy Sunday morning browse.

Julia knows she’d never get the same footfall without the combined appeal of all the shops together, and she’s also confident that her stock is unique enough to make sure her shop gets its fair share of sales. The area becomes a haven for independent businesses, each one strengthening the performance of others.

When deciding whether or not to ‘cluster’, think about your own shopping habits. You’d probably browse several shops when looking for a gift, but not for a bottle of good wine. You’d ‘go shopping’ for new clothes, involving a few different places, but you’d maybe be less likely to shop around different bakeries or bookshops, where products are less differentiated.

📍 Dowse, Brighton, UK. The Lanes in Brighton is a bustling area full of independent shops; clustering totally works for them

Considering the pop-up option

Feeling daunted by your retail space hunt? Hadn’t factored the additional costs into your business plan? ‘Soft launching’ your business with a pop up could be a great chance to prove your concept, without the risk.

Low on admin, commitment, and cost (relatively speaking), on-demand pop-up marketplaces have really taken off in recent years. With the ability to book a retail space as easily as you would an Airbnb, it’s easy to see why. And when you combine that with the option to source stock through CREOATE and send back what doesn’t sell in 60 days, you suddenly have yourself a very simple solution.

We’re going to bring you lots more content on how to craft the perfect pop-up, but in the meantime why not check out Appear Here, We Are Pop Up and Popable, which are three of the most popular platforms here in the UK.

For comparison, we had a look for pop-up spaces in a similar area to the retail listing above, and found spaces going for between £250 and £350 per day. Looking across London as a whole, prices were much more varied — between £50 and £3,000+ per day.

📚 Bookmark for later: How to Set Up a Pop-up Shop

Wrapping up

Sooo renting a space for your shop is a little (a lot) harder than renting a new flat. There’s a lot of red tape, and we hate it!

But if we know one thing, it’s that the independent business community is filled with wonderful, resilient people. And we back you all to jump through these hoops and come out the other side with some gorgeous shops to show for it.

And remember, we’re here to help! If there’s any content you’d like to see on opening a store, we’re all ears. Or why not check out our Retailer Community Group on Facebook, and pitch your question to the people who’ve been there before.

👋 Not registered with CREOATE yet? Sign up now and shop wholesale with us today.

FAQs

1. When's the right time to look for a retail space to lease?

We’d recommend browsing for retail space before or while drawing up your business plan to get a general sense of what the upfront and ongoing costs are going to be for your business.

Once your business finance option (e.g. a loan) comes through, you should be ready to hone in on and sign for a property. The commercial rental market is generally a lot slower moving than the residential one, so you have a bit of breathing space.

Already got an ecommerce store, and not sure when’s the right time to go brick and mortar? Here’s what drove Harriet, founder of Harriet & Rose, to take the leap:

"Space! There’s that moment when you can’t go on having boxes piled up in your hallway. And kitchen. And garage. And shed. I knew I needed premises to facilitate taking the business to the next level, and it was a decision between high street or office. In the run up to Christmas 2020 I organised a Small Business Pop up and knew that when I could talk to my customers about what they were buying, I sold more… and so the decision sort of made itself. Though I was not originally looking for prime retail, which is where I’ve ended up!" — Harriet, Harriet & Rose. Read the full interview.

📚 Bookmark for later: How to Create a Business Plan: What to Include, and How to Format It

2. How long do shop leases run for?

Retail space leases will typically run for between two and 25 years, with around 3-5 being more typical (Savills placed the average commercial lease term at 5.5 years back in 2020).

3. How much deposit do you need to rent a shop in the UK?

You'll typically be expected to pay between three and sixth months' rent as a deposit. The deposit amount should be clearly shown in the commercial space listing.

Read more:

- Top 6 Window Display Ideas

- What is RRP?

- What is an EORI Number?

- 11 Shopfront Signage Ideas

- 11 Best Scandi Wholesale Homeware

- 12 Best Quirky Wholesale Homeware Brands

Browse Popular Categories at CREOATE: Wholesale Jewellery | Wholesale Gifts | Wholesale Stationery | Wholesale Beauty Products | Wholesale Mugs | Wholesale Homeware | Wholesale Pet Supplies | Wholesale Gourmet Food | Wholesale Garden & Outdoor | Wholesale Baby & Kids Products