Between a global pandemic, Brexit, and increased pressure from ecommerce giants like Amazon, it’s fair to say the last few years haven’t been plain sailing for retail businesses. Standing out from the crowd feels even more important — but that can feel pretty hard when the crowd is so big.

You may have noticed larger brands (particularly fashion brands) introducing ‘buy now pay later’ (BNPL) schemes, and with great success; BNPL schemes are growing at a rate of 39% per year, and claim to boost sales by ‘up to 30%’.

But while retail finance options are increasingly common among larger brands, it’s still fairly uncommon to see this offered by smaller retailers. In this post, we’ll walk you through exactly what retail finance is, its pros and cons, and how you can adopt it for your site.

On this page:

- What is retail finance?

- How to offer retail finance (& Klarna alternatives)

- Pros & cons of retail finance

- Final thoughts

- FAQs

What is retail finance?

Retail finance is essentially a way of offering upfront credit to your customers, the most common method being 'buy now pay later' arrangements. So instead of a customer having to pay the full amount before receiving their items, they’re able to take the item home before it’s paid for (either in part, or in full). It’s kind of like offering an alternative to credit cards. Retail finance is sometimes also referred to as ‘point of sale finance’, or ‘POS finance’.

📚 Looking for advice on financing your retail business instead? Read our Guide to Financing Your Retail Business

How to offer retail finance as a small business

1. Use your own technology

Offering your own retail financing option is possible (we do it here at CREOATE), but it’s definitely not a simple solution. You need to have the technology and people-power to prevent it being used fraudulently, and you assume all the legal and financial risks of offering credit — if your customers don’t pay up, you’ll lose money, or need to start legal proceedings to recover it.

2. Explore options with your bank

It’s worth checking whether your bank can support you in offering retail finance solutions to your customers. This is something Barclays offers, and other banks are likely to follow suit in supporting their retail customers with this increasingly-popular technology.

3. Try an out-of-the-box solution

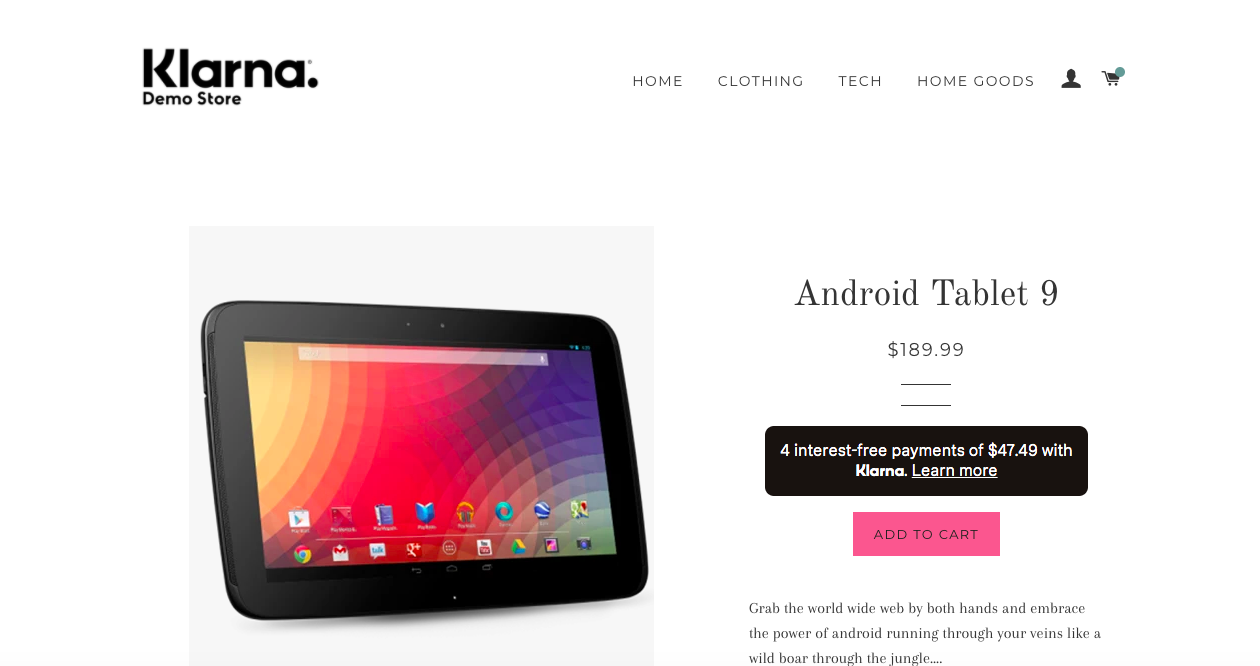

Klarna is the most popular out-of-the-box ‘by now pay later’ system, and integrates with most key ecommerce platforms quickly and easily. It offers customers the chance to pay in four interest-free instalments, and even flags this directly on your product pages (although this is optional) for maximum impact on conversions.

The downside is the cost. Klarna absorbs all the financial risk of retail finance, and pays you the full amount as soon as a purchase is made — but you pay a percentage of each transaction (up to $0.30 and 5.99%). However keep in mind that this includes credit card processing fees, which would normally cost 1.5-2.9% per transaction, anyway.

3 Klarna alternatives for small businesses

Klarna is the platform most people think of when they hear 'buy now pay later'. But there are plenty of other platforms offering a great alternative service:

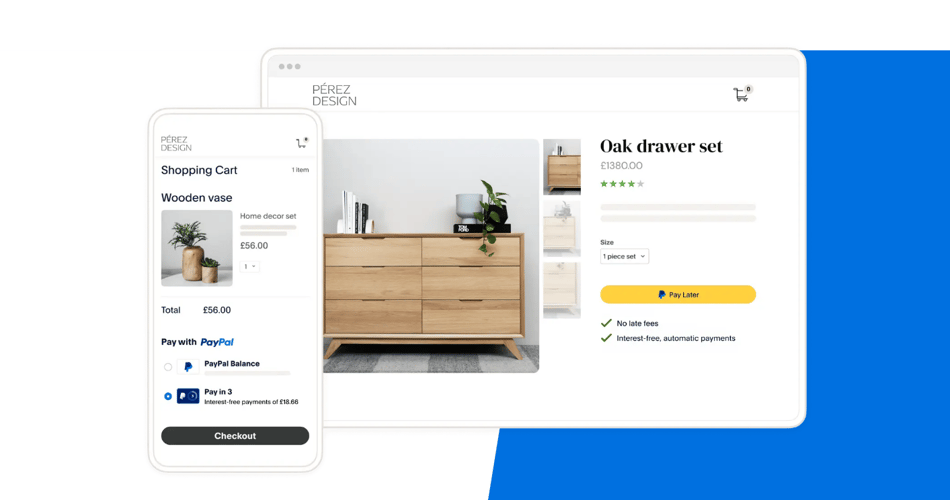

1. PayPal Pay in 3

📆 Customers pay in: Up to 3 instalments interest-free

💸 Cost: Included with PayPal checkout at no additional cost (just the regular transaction fee of 1.2% - 2.9% + 30p)

PayPal is a globally-recognised and trusted brand, which gives this pay later service a leg up over its smaller rivals. If you already offer PayPal as a payment method, this is an easy extra to tack on.

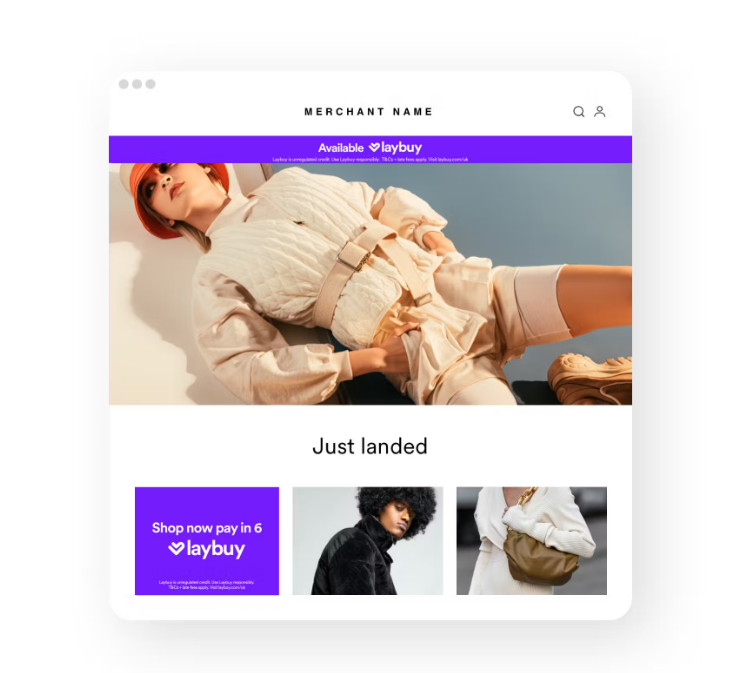

2. Laybuy

📆 Customers pay in: Up to 6 instalments interest-free

💸 Cost: 4%-10% per transaction

Laybuy lets customers pay across six equal instalments (the highest number we've seen), but also comes with a pretty hefty transaction fee. If you sell high value items, such as furniture, the extra instalments might make all the difference to your customers, and therefore to your conversion rates — but you'll need to keep a close eye on it.

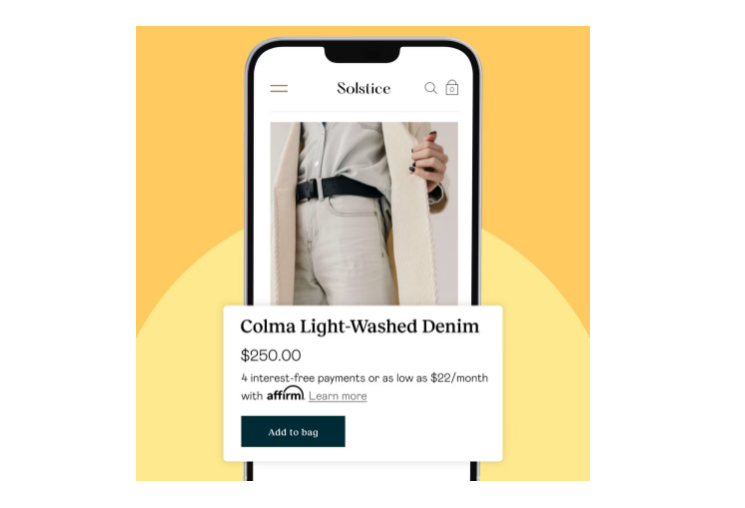

3. Affirm

📆 Customers pay in: Up to 4 instalments interest-free

💸 Cost: Typically 5.99% + $0.30 per transaction, but can vary

Affirm lets your customers pay in up to four instalments interest-free, but uses smart automated technology to predict the preferred payment setup in each case, with customers able to split the cost of purchases across up to 36 months. Like Klarna, Affirm also integrates smoothly with most major ecommerce platforms.

Pros and cons of retail finance for small businesses

Now we’ve shown you what retail finance is, and how to go about implementing it, let’s look at the key pros and cons:

Pros of using retail finance as a small businesses

1. Stand out from competitors

As we mentioned up top, not many small businesses are using retail finance options such as Klarna. That’s despite 9.5 million Brits claiming they actively avoided buying from retailers that didn’t offer buy now pay later solutions back in 2020.

If you’re struggling to stand out from your competitors (and who isn’t…), this is a quick way to offer a point of difference. The big brands have already done the hard part by bringing these technologies into the mainstream, so you don’t have to worry about customers not trusting them (something that’s typically a big initial barrier for fintech services).

2. Improve your conversion rate

It is likely that you will make more sales through offering a retail finance option. Klarna boasts some really amazing success stories here, with conversion rate increases of up to 44%. There’s no guarantee you’ll see an increase this substantial (especially if you sell to an older demographic, or sell relatively low-value products), but it’s fair to say that some increase is likely.

The most important thing is to monitor your conversion rate very carefully once you’ve implemented a retail finance option. It’s essential to not take anything for granted — as anyone who has worked in ecommerce knows, one person’s ‘sure win’ doesn’t guarantee a ‘sure win’!

3. Increase your average order value

As above, it is likely (but not guaranteed) that offering retail finance will increase the average order value placed on your site. Again, it’s important to monitor this over a period of several months — it may be the case, for example, that order values go up, but that customers end up making purchases less frequently. It’s important to continue to interrogate the data you have available.

Cons of using retail finance as a small businesses

1. Cost and/or financial risk

As we’ve covered above, any retail finance option involves some kind of cost, either in the form of a per-sale commission, financial risk, and/or tech work and extra man hours. The trick is to make sure that the benefits clearly outweigh this.

2. Relying on another party to give your customers a great experience

If you involve a third party in your payments process, part of the customer experience is no longer within your control. It’s possible that, if your customer has a negative experience with the retail finance provider, it could put them off ordering through your website again, or they could even end up asking for a refund, or leaving a negative review.

3. Is it ethical?

This is a fairly subjective disadvantage, but one which feels worth mentioning. By now pay later services like Klarna have become hugely popular in recent years, but there have been valid questions raised about how ethical they are. Specifically, the criticism is that they encourage people to live beyond their means, and to get into debt.

As a result, by now pay later services are now to be better regulated by the Financial Conduct Authority. But there are still high profile people — like influencer Oghosa Ovienrioba — who won’t promote Klarna due to the risk of it getting people, especially younger ones, into cycles of debt.

Final thoughts

Retail finance, as with many decisions, involves some degree of risk alongside the chance of positive impact. The good thing is that new technologies make it easy to add and remove this functionality from your site, and to assess its impact. There’s little to be lost from giving it a go — and if you do so now, you have the chance to really set yourself apart from your competitors. Because whatever you think of ‘buy now pay later’ schemes, one thing’s for sure: they’re not showing any signs of slowing down.

Not registered with CREOATE yet? Sign up now and shop wholesale with us today.

📚Bookmark for later: Top 7 Wholesale Marketplaces: Which is Right for You?

FAQs

If I use a retail finance platform, when will I get paid?

Most retail finance platforms will pay you for the full value of the transaction upfront, and then assume all responsibility for collecting the payments directly from the customer. If they don't pay, this won't impact you. However, this is only the most common setup for retail finance platforms — please be sure to always check the specific conditions of any platform you try out.

How much does retail finance cost?

Most retail finance platforms are free for your end customer to use (although they'll incur fees if they pay late), and charge from 1.2% + $0.30 per transaction for you, the merchant, to use. Again, always check the specific terms of any platform you're exploring.