.jpg?width=1200&height=798&name=venti-views-1cqIcrWFQBI-unsplash%20(1).jpg)

If you’ve explored shipping internationally, you’ve probably come across the term Harmonized System (HS) code.

Harmonized System (HS) codes are six digit codes that identify and classify your product when shipping it across borders. It's used to regulate taxes and, when correctly used, means a delay- and hassle-free customs process, and smooth international sales.

But do you need to use HS codes? And if so, how do you find the right one? Stick with us as we cover everything you need to know.

On this page

- What is an HS code?

- Why is getting the HS code correct so important?

- What does an HS code look like?

What is an HS code?

A Harmonized System (HS) is a six digit code, administered by the World Customs Organization (WCO), that helps customs identify products quickly, allowing for a smooth tracking of trade and taxation.

This six digit code serves as a universal language between countries, ensuring accurate product classification and easy international shipping. It can be used throughout different countries to ensure that people are getting the right products and there are no issues when shipping internationally.

While the standard HS code can provide valuable information, companies sometimes want to make their code more specific to the product they are selling.

Why is getting the HS code correct so important?

Although it seems like a simple concept, the HS code determines the taxes you are charged when shipping a package internationally. So, if you were to have the wrong HS code on a product, this could cause you to have to pay a higher tax rate on your shipment. A wrong code can also cause additional charges and holdups.

What does an HS code look like?

When you are writing a blog post or essay, you typically start with a bold title, which gives your reader a broad sense of what you are writing about. Within your essay, you will have other subtitles that are going to go more in depth as to what your article is about. An HS code works similarly.

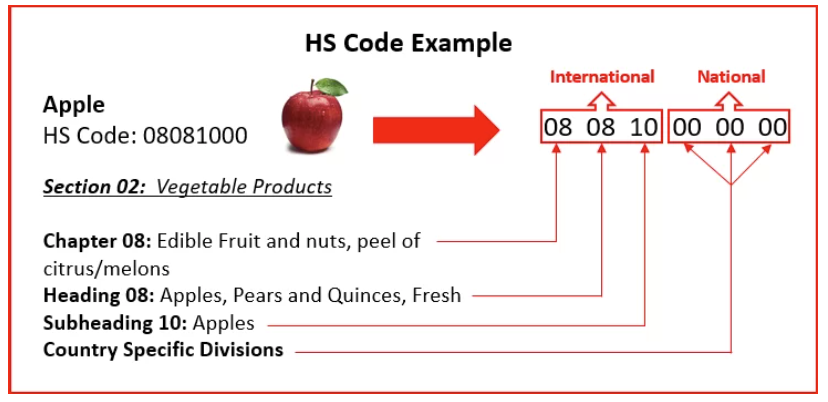

Image source: GCE Logistics

HS codes are sectioned into three categories that each include two digits: Chapter, Heading, and Subheadings. Within each category, the product is able to be described more specifically. The chapter is describing in a broad sense what the product is. Whether it is a fruit, a ketchup dispenser, coffee etc. The heading begins to specify more of what the product is before ending with the subheading digits. The subheading is going to tell you specifically what the item is.

FAQs

Where can I find an HS code?

To find the right HS code, go to GOV.UK and use their tariff classification tool. Once you have accessed the website you should look for the code that has the most similar description to the product you are looking for.

What is a commodity code?

Commodity codes allow you to estimate what you will be paying for importing or exporting goods. A commodity code is an umbrella term for different international shipping codes including HS codes, tariff codes, or taric codes.

Does every product have an HS code?

All goods, including food and raw materials, have an HS code to calculate customs duties and collect trade statistics. Over 98% of goods that are traded internationally are going to have an HS code.

Can a product have more than one HS code?

Products can only have one HS code per container. In some cases, it is important to look at the heading to make sure it is the one that describes your product the most.

Are HS codes universal?

Almost. HS codes are used by the 185 countries that are part of the World Customs Organization, which reportedly account for 98% of total international trade between them.

Not signed up with us yet? Sign up to CREOATE for free and start shopping wholesale today.